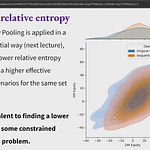

Section 3.2.2 in the Portfolio Construction and Risk Management book gives a brief introduction to generative machine learning methods for investment market simulation, including variational autoenco…

4. Time Series Variational Autoencoders

This video presents time series variational autoencoders (VAEs) and explores how they can be used for investment simulation and missing data imputation.

Mar 09, 2025

∙ Paid

Recent Posts