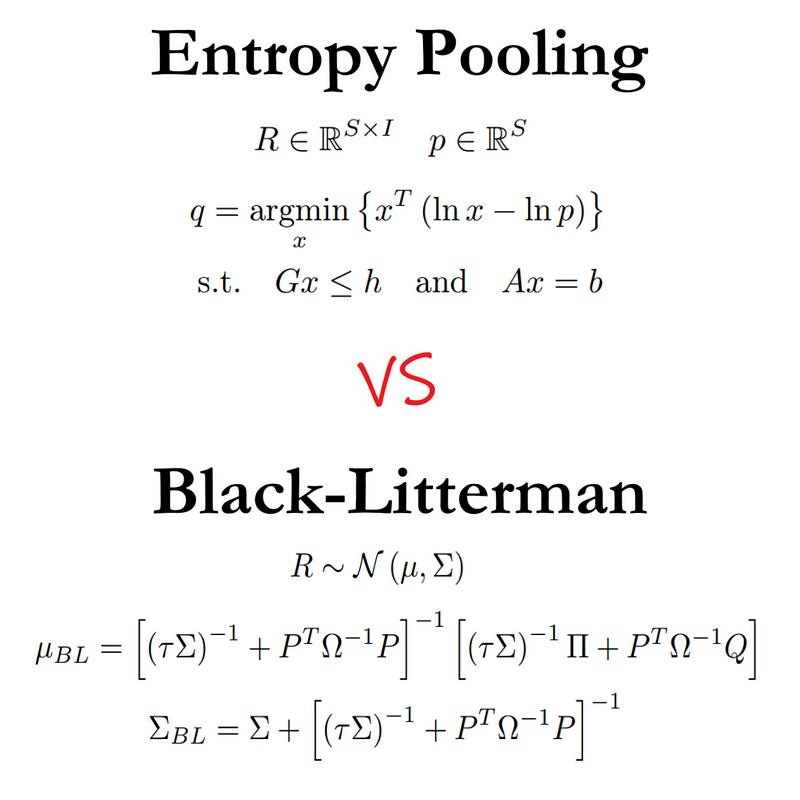

Entropy Pooling vs Black-Litterman

This article compares Entropy Pooling (EP) to the Black-Litterman (BL) model.

This article compares Entropy Pooling (EP) to the Black-Litterman (BL) model. In short, Entropy Pooling is a views and stress-testing method for fully general Monte Carlo distributions with flexible joint scenario probabilities. Black-Litterman is a views method that relies on the CAPM model, the normal distribution, and other unrealistic assumptions.

Entropy Pooling

When you work with a method for an extended period of time, you tend to forget that not all people know and understand its basics. I experienced this recently when someone gave me feedback on the Sequential Entropy Pooling Heuristics article, see Vorobets (2021)¹, saying that it wasn’t clear what the purpose of EP was.

At first, I couldn’t understand how it wasn’t clear. After all, the recap gives a very short and sweet description of what happens when you solve the EP problem, but then I realized that the issue was that this person didn’t know why one would solve the particular mathematical problem in the first place. As a consequence, I made this video explaining the Entropy Pooling intuition:

You can also find this YouTube video² that gives more perspectives and and a simple example of sequential EP with views on mean and volatility of S&P 500 and STOXX 50. For more details about the sequential EP algorithms, see this YouTube video³.

For an overall introduction to EP and aspects related to view confidences, it is recommended to read the original article by Meucci (2008)⁴, while the notation is more concise and to the point in Vorobets (2021)¹, formally introducing sequential EP that usually gives significantly better results. EP can also be combined with Bayesian networks for causal and predictive analysis, see Vorobets (2023)⁵.

For a cohesive presentation of all Entropy Pooling aspects, see Chapter 5 in the Portfolio Construction and Risk Management book.

Black-Litterman

I am by no means an expert on the BL model and its extensions. I decided to discard it due to its many highly unrealistic assumptions and duct tape engineering more than 10 years ago when I learned about it for the first time while writing my master’s thesis on Bayesian portfolio selection. In this article, I focus on the original BL model, while several adjustments have been proposed, see Meucci (2008)⁶. However, I view these adjustments not as solutions to the fundamental problems but additional duct taping on a poor foundation.

The BL model makes many highly unrealistic assumptions regarding markets, for example, that the CAPM holds, and that markets are normally distributed. There is an additional need to specify a risk aversion parameter to determine the “equilibrium expected returns”, and a tau parameter that needs to be specified somehow. As I do not recommend using the BL model, I will not go into details with these aspects, while they can be found in Meucci (2008)⁶.

I have seen people write that EP and BL give the same results when markets are normally distributed, but I am not aware of any material showing that this is actually the case. The BL model has an extra tau parameter and some logical inconsistencies with view confidences, see Meucci (2008)⁶, while EP handles view confidences in a natural and logically consistent way. Hence, I do not see how the two methods will give the same results in the normally distributed case.

Conclusion

There is absolutely no reason to continue using BL when EP is now well-known with fast and stable Python implementations freely available online, see the entropy-pooling⁷ package. If you want to combine EP with CVaR optimization, you can use the fortitudo.tech⁸ package. For an introduction to the combination between EP and CVaR, see the Entropy Pooling and CVaR Optimization in Python⁹ article.

Entropy Pooling is a core element of the next generation investment framework that also utilizes fully general Monte Carlo distributions and CVaR analysis. For a video introduction to some of the things that you can do with the next generation framework, see this YouTube video¹⁰.

If you want to build a really deep understanding of the next generation investment framework, you can read the Portfolio Construction and Risk Management book.

[1]: Vorobets, Anton, Sequential Entropy Pooling Heuristics (October 5, 2021). Available at SSRN: https://ssrn.com/abstract=3936392

[2]: Sequential Entropy Pooling video: https://www.youtube.com/watch?v=DK1Pv5tuLgo

[3]: Entropy Pooling video: https://www.youtube.com/watch?v=hDt103zEML8

[4]: Meucci, Attilio, Fully Flexible Views: Theory and Practice (August 8, 2008). Fully Flexible Views: Theory and Practice, Risk, Vol. 21, №10, pp. 97–102, October 2008, Available at SSRN: https://ssrn.com/abstract=1213325

[5]: Vorobets, Anton, Causal and Predictive Market Views and Stress-Testing (May 11, 2023). Available at SSRN: https://ssrn.com/abstract=4444291

[6]: Meucci, Attilio, The Black-Litterman Approach: Original Model and Extensions (August 1, 2008). Available at SSRN: https://ssrn.com/abstract=1117574

[7]: entropy-pooling Python package. Available at: https://github.com/fortitudo-tech/entropy-pooling

[8]: fortitudo.tech Python package. Available at: https://github.com/fortitudo-tech/entropy-pooling

[9]: Entropy Pooling and CVaR Optimization in Python: https://medium.com/@ft_anvo/entropy-pooling-and-cvar-portfolio-optimization-in-python-ffed736a8347

[10]: Anton Vorobets, Next Generation Investment Analysis @ The London Quant Club: https://www.youtube.com/watch?v=4ESigySdGf8