Good Investment Models

This is the April edition of the Portfolio Construction newsletter that also includes a LinkedIn posts recap.

I am always struck by a great amount of insight and clarity on this particular day.

This year, I have realized what defines a truly good investment model: it must be simple to implement and easy to understand.

If you can add "award-winning" to that, investment alpha is almost guaranteed.

It absolutely does not matter if the model:

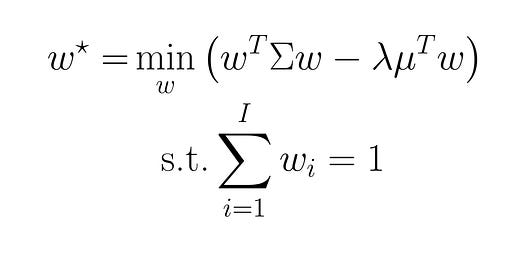

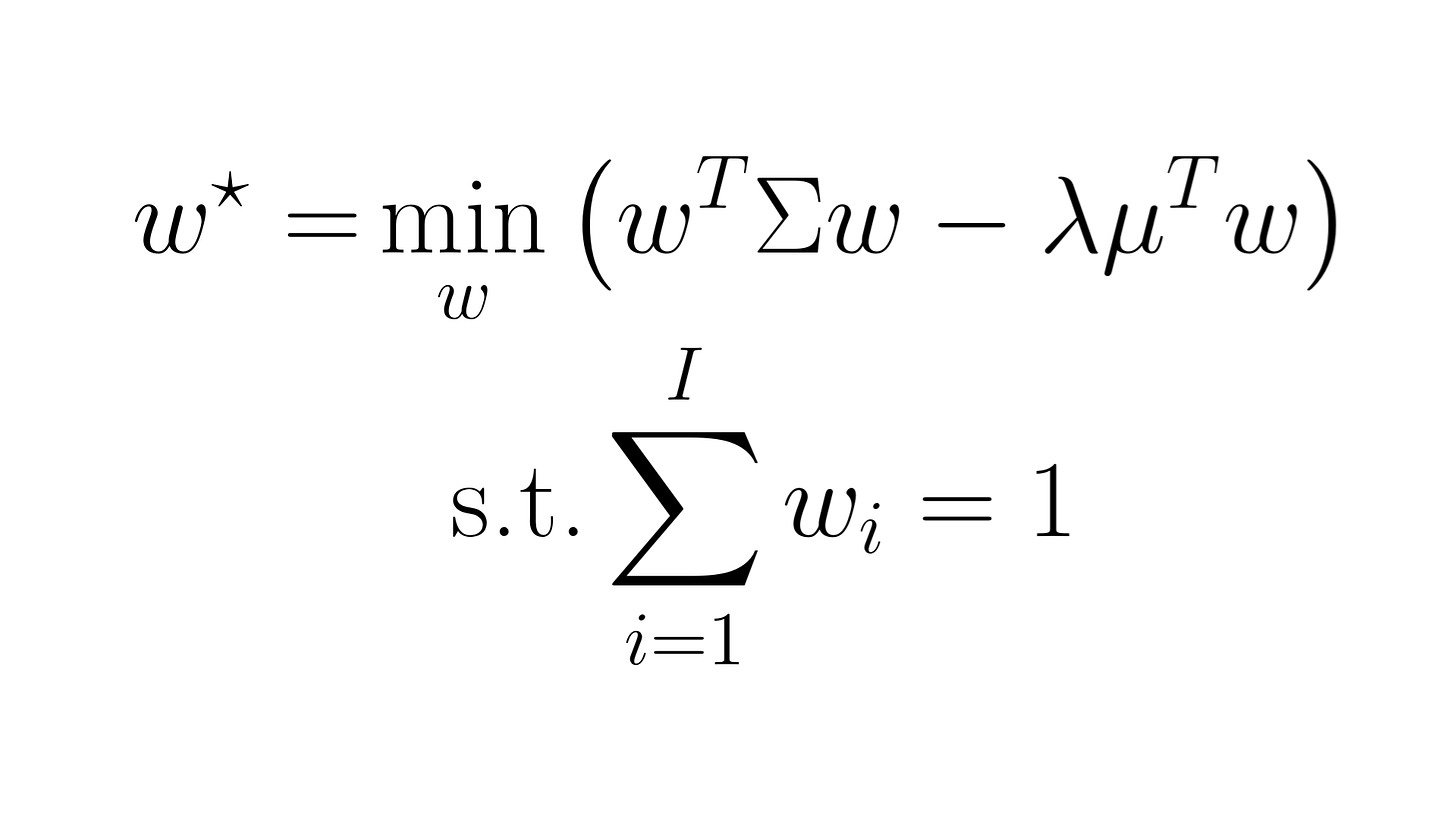

Builds on highly unrealistic assumptions.

Minimizes the upside as much as the downside.

Is easily available to mom-and-pop investors.

Positive excess returns come from doing exactly what most other market participants are currently doing.

Some crazy people claim that you must use methods based on realistic assumptions and focus on minimizing the downside while maintaining the upside.

You can ignore these people, because they are the 5% minority. And we all know that it is the remaining 95% who consistently outperform the market.

I wish I was able to maintain such clarity the other days of the year, but knowing myself I probably will go back to saying nonsense like in the video below:

A more serious note

Over the last couple of months, I have been sharing very deep quantitative investment management content. You have probably only seen a small fraction of it.

For the deepest insights, I therefore encourage you to subscribe to the Quantamental Investing publication, so you don't miss out on any of it.

You can catch up on all the content by browsing the archive or the specific sections that you can find in the top navigation bar.

I will deactivate free previews of paid posts this Saturday, so if you want to explore some of the currently available paid posts, make sure to claim your free preview now.

For a deep and cohesive presentation of the investment framework and its methods, see the Portfolio Construction and Risk Management book.

I will be editing the book over the coming months, so please let me know if something is unclear or you spot a typo either in the book or its Python code.

Posts recap

Below is a recap of the most important posts since the last newsletter.

Time series variational autoencoders video:

How to optimize the tail risks of fully general return distributions:

Sequential Entropy Pooling video:

https://www.linkedin.com/feed/update/urn:li:activity:7306673354034339841/

Time series variational autoencoders PDF document:

High-level presentation of the derivatives portfolio management framework:

Why some people continue to promote and use mean-variance:

High-level presentation of the Causal and Predictive Market Views and Stress-Testing framework:

Portfolio optimization functionality video walkthrough:

Celebrating my New Year's resolution: