Learn from the Source

July 2025 edition of the Portfolio Constructions newsletter about the importance of evaluating your sources.

This newsletter gives you the last opportunity to get access to the Applied Quantitative Investment Management course at the best price.

I will share the first lecture on Thursday, July 3rd. After that, the subscription price will increase from the current €100 per year.

The subscription will give you access to video lectures, their slides, and a chat where you can ask me questions about the content.

Lectures will be posted each Thursday the next 12 weeks and include detailed walkthroughs of the Portfolio Construction and Risk Management book as well as its accompanying Python code.

As a bonus, you also get access to all the exclusive case studies for paid Quantamental Investing subscribers.

The Applied Quantitative Investment Management Course

Over a 12 week period from July to September, I will be giving a course that carefully goes through all chapters of the Portfolio Construction and Risk Management book as well as its accompanying Python code.

You can get access to the course, its slides, and asking me questions by becoming a paid subscriber to the Quantamental Investing publication.

Until July 3, the subscription price is just €100 per year (you can cancel after the first year). If you use your work email, consider expensing it and/or get a group subscription.

If you have any questions about the course practicalities, please post them in the comment here (see also the other questions and answers).

Be careful who you learn Sequential Entropy Pooling from

I recently learned about a Sequential Entropy Pooling (SeqEP) knock-off.

It is a software implementation from people who tried to claim credit for ideas that are obviously not theirs and intentionally avoided citing the original article.

I know these people. I helped them promote their work initially, and they asked me to contribute with my Entropy Pooling insights.

With time, I realized that these people have other intentions than simply sharing open-source software and cut my ties with them.

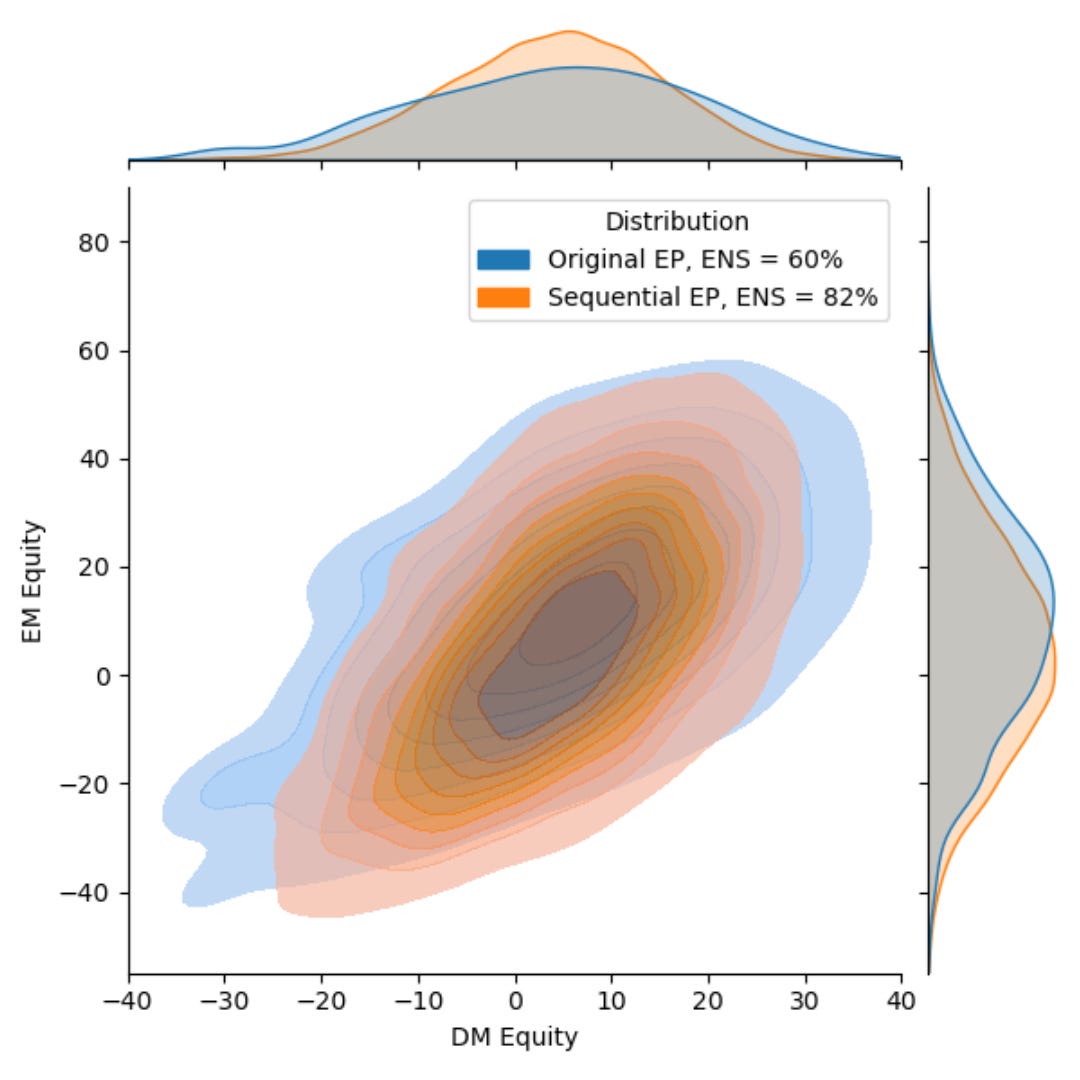

Disregarding their immoral behavior, I studied their implementation that obviously copies the H1 Sequential Entropy Pooling algorithm.

However, they decided to add their own "innovations" to the algorithm, clearly illustrating that they do not understand why the sequential view processing works.

No one who actually understands the essence of the sequential algorithms would implement the adjustments they did, because it is obvious that they lead to worse expected performance.

They also make some statements about Entropy Pooling that are outright wrong, which is comical considering that it is clearly explained in some of the sources they cite.

So, these people tried to claim credit for ideas that are clearly not theirs and then adjusted the algorithm in a way that makes it worse. Bravo :-)

Naturally, it is hard for me to find any positive things to say about the above. Knowing how they are, and understanding the quality of their work, I recommend that you avoid them.

Proper Sequential Entropy Pooling (SeqEP)

I encourage you to learn about Sequential Entropy Pooling from Chapter 5 of the Portfolio Construction and Risk Management book. It contains all the information you need.

I have been working with Entropy Pooling extensively for more than eight years, and I discovered the sequential algorithms through practical applications of managing complex multi-asset portfolios.

I continue to work closely with institutional investment managers to further understand how Sequential Entropy Pooling helps them solve their views and stress-testing problems.

Implementing Sequential Entropy Pooling to run in a fast and stable way is incredibly hard. It requires highly specialized algorithms that we have developed through many years of continued progress and research.

We have witnessed several failed attempts over the last couple of years and therefore encourage you to subscribe to the Investment Analysis module instead of wasting time and money on trying to implement a production-quality version of Sequential Entropy Pooling yourself. So far, such attempts have resulted in failure at best and lost jobs at worst.

Post recap

Below is a recap of the most important LinkedIn posts since the last newsletter.

The Normal Distribution Myth article (SSRN: https://ssrn.com/abstract=5283255)

How the Black-Scholes model is used in practice:

A warning about the Sequential Entropy Pooling knock-off:

https://www.linkedin.com/feed/update/urn:li:activity:7339240994158096385/

What it means to be approximately correct in investment management:

How I evaluate investment methods:

Time- and State-Dependent Resampling SSRN article:

https://www.linkedin.com/feed/update/urn:li:activity:7342532863281565696/

Summary of the Applied Quantitative Investment Management course:

How to assess if TAA is worth the extra effort: