This is the twelfth lecture of the Applied Quantitative Investment Management course.

This lecture carefully goes through Chapters 7 and 8 from the Portfolio Construction and Risk Management book and its accompanying Python code.

This lecture includes important perspectives on tail risk hedging as well as a Sequential Entropy Pooling case study that implements a tail risk diversification scenario.

Finally, there is a summary of the next-generation investment framework in comparison with the old variance-based approach.

Applied Quantitative Investment Management course

As a paid subscriber, you have full access to the course and the expanding collection of exclusive case studies that use the investment framework presented in the Portfolio Construction and Risk Management book.

The Applied Quantitative Investment Management course will run for 12 weeks with lectures on Thursdays.

To ensure that you get access at the best price, it is recommended to secure your paid subscription now.

If you subscribe using your work e-mail, consider expensing the subscription and potentially using the group subscription option.

You can also opt for a free subscription, which gives you access to the free content and short lecture previews.

Watch the first lecture free here:

Lecture 1: Intro and Python setup

This is the first lecture of the Applied Quantitative Investment Management course that goes through the Portfolio Construction and Risk Management book and its accompanying Python code.

Watch the previous lecture here:

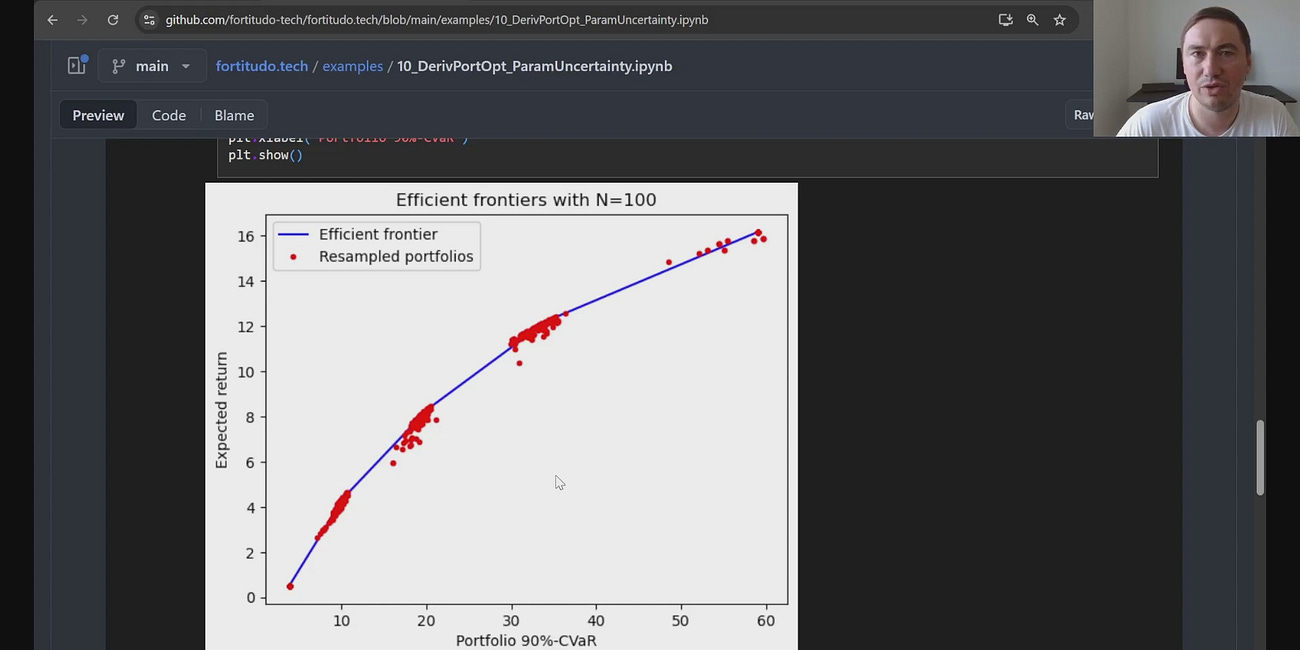

Lecture 11: Derivatives Portfolio Optimization and Rebalancing

This is the eleventh lecture of the Applied Quantitative Investment Management course.