Portfolio Optimization

September 2025 edition of the Portfolio Construction newsletter about tail risk portfolio optimization with parameter uncertainty and derivatives.

After finalizing the chapters on stylized market facts, investment simulation, instrument pricing as well as market views and stress testing, we are now ready to start the lectures on portfolio optimization in the Applied Quantitative Investment Management course.

Portfolio optimization with fully general distributions, tail risk budgets, parameter uncertainty and derivatives is presented in Chapter 6 of the Portfolio Construction and Risk Management book.

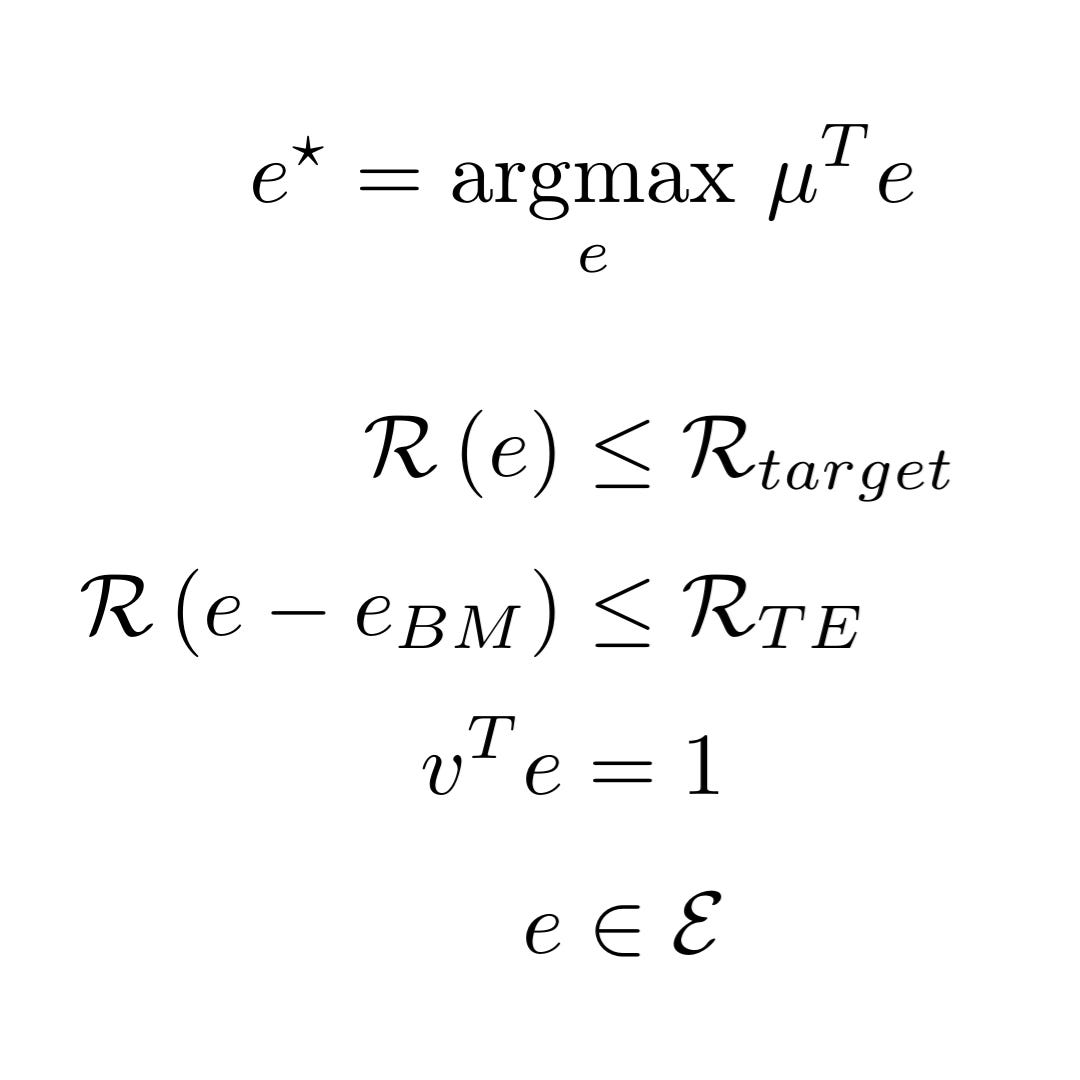

We will first learn why the problem from the cover image to this newsletter is the interesting portfolio optimization problem from a total portfolio approach.

First, there will be an explanation of how we can handle derivatives in an elegant way by separating exposures from market values.

After that, we will present the Resampled Portfolio Stacking approach for handling fully general parameter uncertainty and how this can be used for intelligent rebalancing analysis.

If you still have not seen the course, there is an overview of the first eight lectures below.

Applied Quantitative Investment Management lectures

Below is an overview of the lectures as of September 2, 2025. Next lecture will be published on September 4, 2025.

You can get access to all lectures as well as asking me questions by becoming a paid subscriber.

If you subscribe using your work e-mail, consider expensing the subscription and potentially using the group subscription option.

You can also opt for a free subscription, which gives you access to the free content and short lecture previews.

LinkedIn posts recap

Below is a LinkedIn posts recap since the last newsletter.

Understanding Fortitudo Technologies' investment framework and methods:

A detailed presentation of Entropy Pooling and common view specifications:

A brilliant explanation of the anti-scientific tendencies in academic finance and economics:

https://www.linkedin.com/feed/update/urn:li:activity:7361000539297406976/

A thank you note for the positive feedback on the Applied Quantitative Investment Management course:

The Normal Distribution Myth video:

Sequential Entropy Pooling lecture:

https://www.linkedin.com/feed/update/urn:li:activity:7364276515800236035/

Some perspectives on Total Portfolio Approach (TPA):

https://www.linkedin.com/feed/update/urn:li:activity:7366079471872880642/

Causal and predictive market views and stress testing lecture: