Quantamental Catch-Up

August 2025 edition of the Portfolio Construction newsletter, containing an overview of the Applied Quantitative Investment Management course.

Many of you have undoubtedly enjoyed the summer holidays, so you might have missed out on the first five lectures of the Applied Quantitative Investment Management course.

So far, we have been through the first four chapters of the Portfolio Construction and Risk Management book, reaching a point where we understand stylized market facts, the investment simulation framework, and multi-asset instrument pricing.

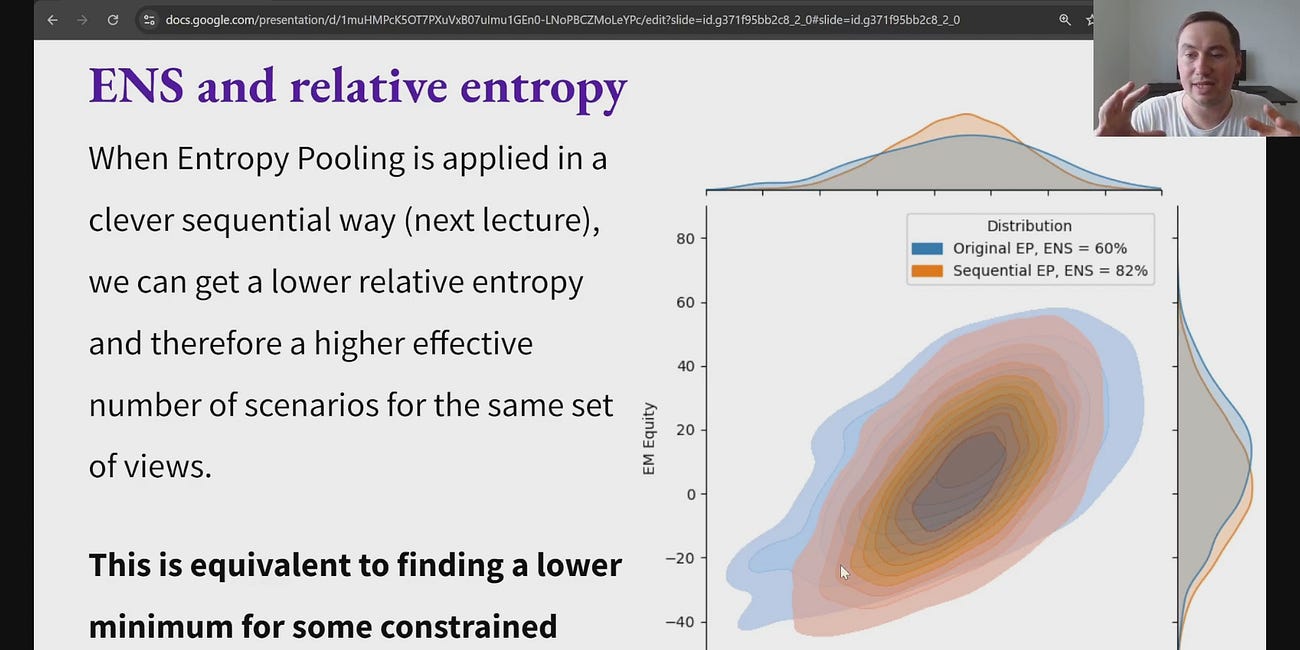

We are now ready to proceed to the actual investment analysis and portfolio optimization, which includes market views and stress testing using Sequential Entropy Pooling and portfolio optimization with parameter uncertainty using Resampled Portfolio Stacking.

I plan to spend three lectures on each of these topics in order to go through all the details very carefully. If you still have questions after that, you can ask me in the Substack chat or in the lecture comments.

To get full access to all the above and an expanding collection of exclusive case studies, you can subscribe to the Quantamental Investing publication.

If you have any feedback or suggestions for how I can improve the remaining lectures, please do not hesitate to reach out.

Applied Quantitative Investment Management course links

Lecture 1: Intro and Python setup

This is the first lecture of the Applied Quantitative Investment Management course that goes through the Portfolio Construction and Risk Management book and its accompanying Python code.

Lecture 2: Stylized Market Facts

This is the second lecture of the Applied Quantitative Investment Management course.

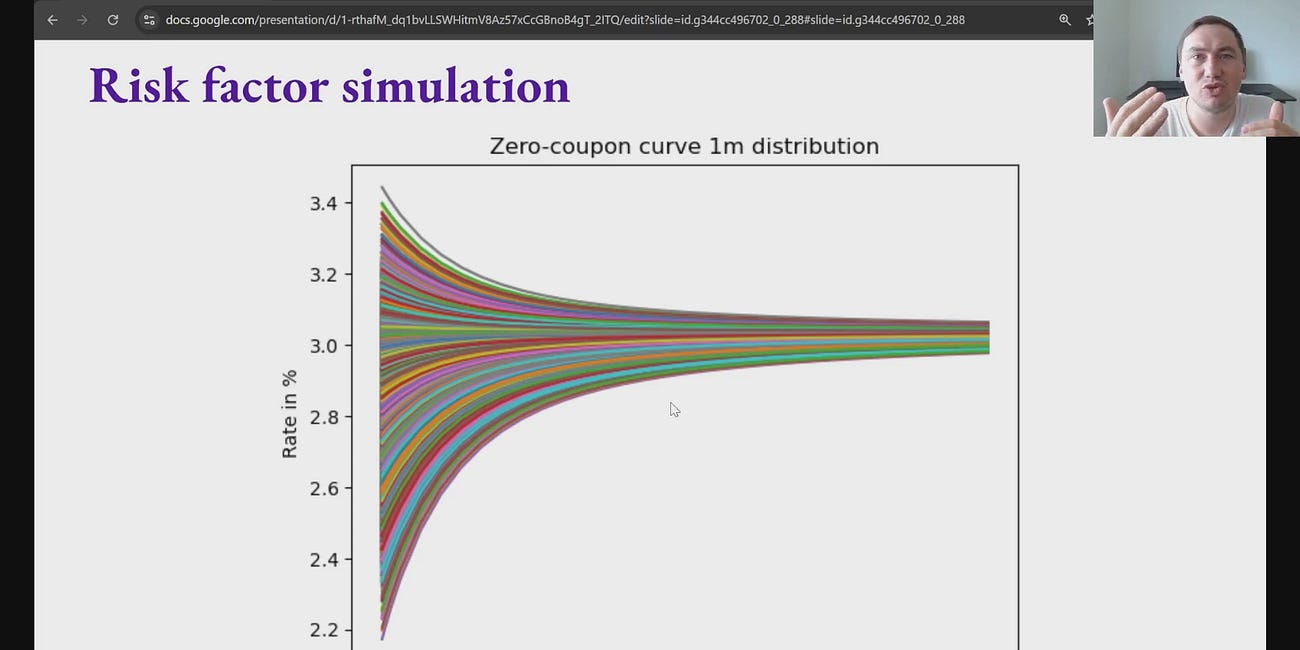

Lecture 3: Investment Simulation Framework

This is the third lecture of the Applied Quantitative Investment Management course.

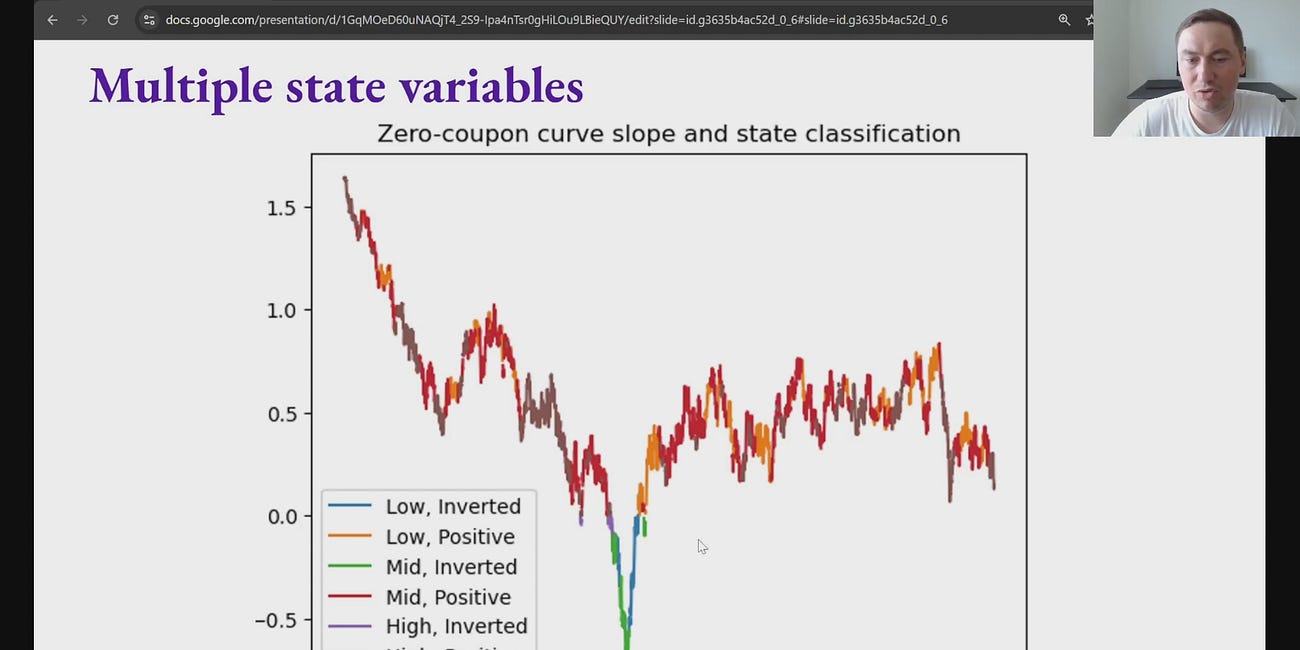

Lecture 4: Resampling and Generative Machine Learning

This is the fourth lecture of the Applied Quantitative Investment Management course.

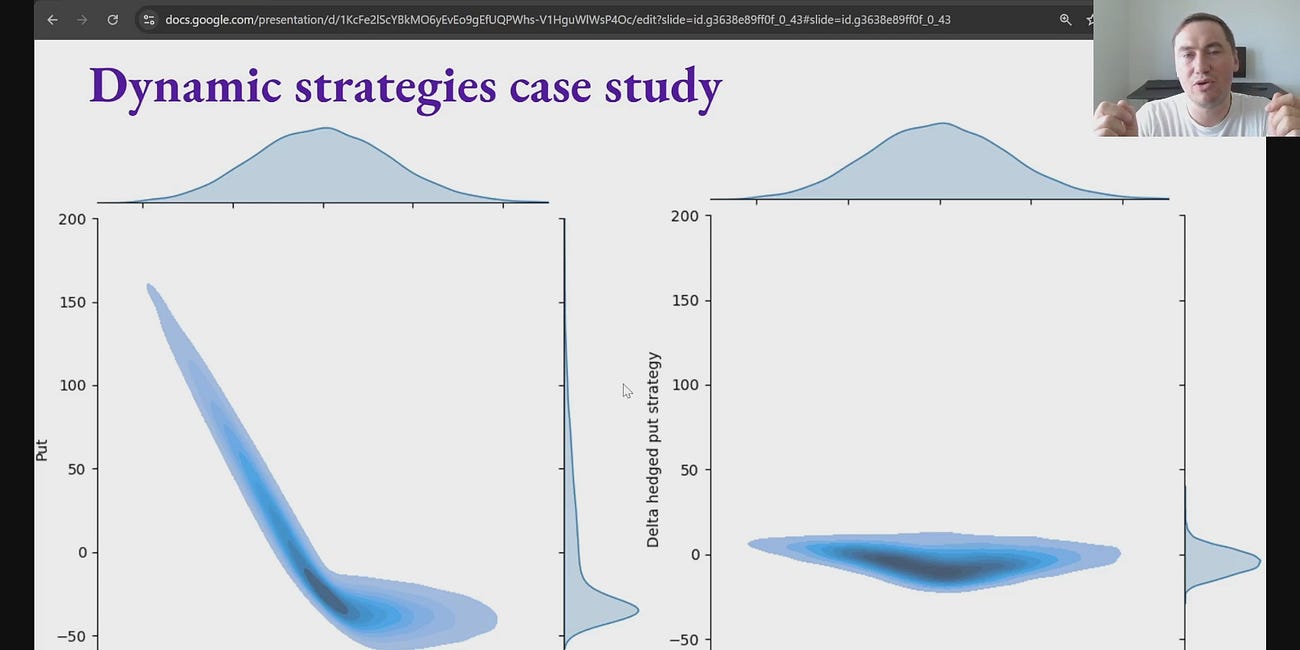

Lecture 5: Instrument Pricing

This is the fifth lecture of the Applied Quantitative Investment Management course.

Lecture 6: Entropy Pooling

This is the sixth lecture of the Applied Quantitative Investment Management course.

Posts recap

Below is a LinkedIn posts recap since the last newsletter.

Lecture 1 description:

Why I am direct in my critique of old variance-based methods:

Lecture 2 description:

Thank you for reading the Quantamental Investing publication:

https://www.linkedin.com/feed/update/urn:li:activity:7349781694029139968/

Relationship between variance and percentiles:

Lecture 3 description:

Portfolio management framework for derivatives update:

Celebrating my silly New Year’s resolution:

Lecture 4 description:

https://www.linkedin.com/feed/update/urn:li:activity:7354115867762135041/

Overview of Quantamental Investing playlists:

Academic “trash” poll:

Generative machine learning vs traditional methods for investment simulation:

Lecture 5 description including why we should focus on risk factor paths:

Applied Quantitative Investment Management course announcement:

https://www.linkedin.com/feed/update/urn:li:activity:7357753597465391104/