This is the twelfth video that goes through the fortitudo-tech Python package available at: https://github.com/fortitudo-tech/fortitudo.tech1.

The video goes through the eleventh example, which is the accompanying code to the Derivatives Portfolio Optimization and Parameter Uncertainty SSRN article2.

See also last weeks post that introduced the fundamental Resampled Portfolio Stacking perspectives3.

For an overview of resampled portfolio optimization, see this Substack post4.

For a deep and pedagogical presentation of the Resampled Portfolio Stacking approach, see Portfolio Construction and Risk Management book5.

You can still contribute to the project and get perks for your contribution by becoming a paid subscriber to this publication, which will give you access to the Applied Quantitative Investment Management course and the expanding collection of exclusive case studies.

Watch the next video here:

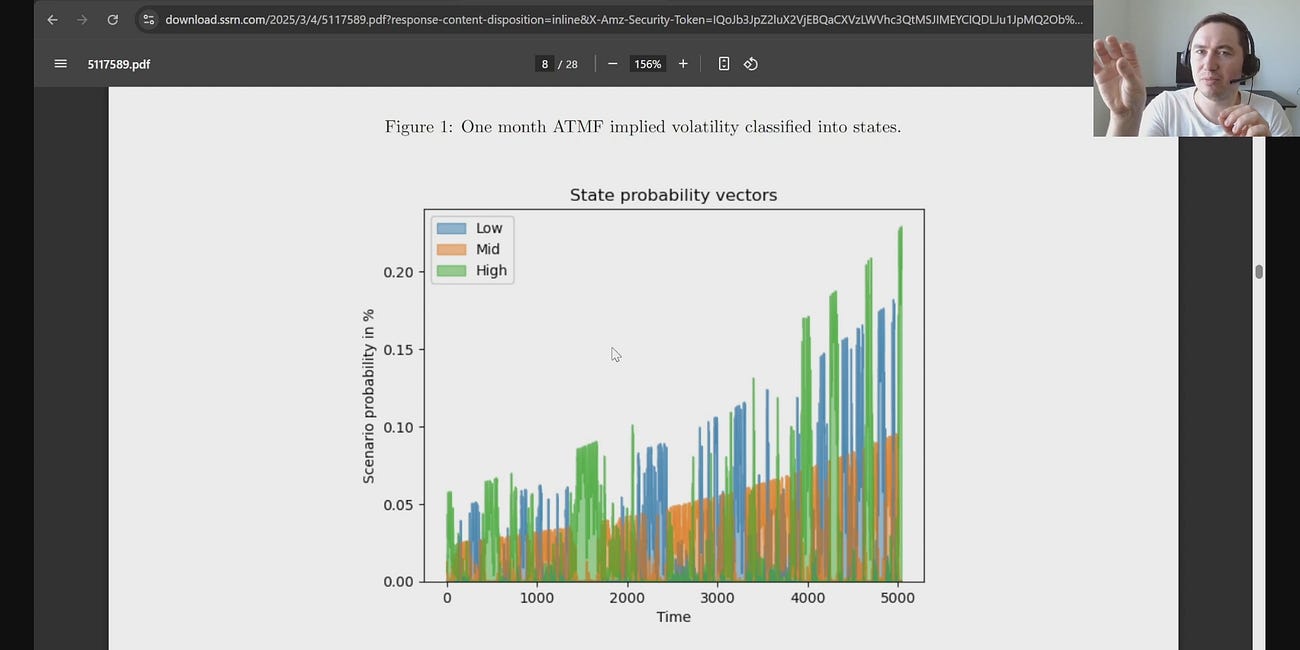

11. Time- and State-Dependent Resampling

This video goes through the Time- and State-Dependent Resampling SSRN article and its accompanying Python code.

This video is also available on YouTube6 if you prefer watching it there.

GitHub repository for the fortitudo.tech Python package: https://github.com/fortitudo-tech/fortitudo.tech

Derivatives Portfolio Optimization and Parameter Uncertainty SSRN article: https://ssrn.com/abstract=4825945

9. Portfolio Optimization and Parameter Uncertainty video post: https://antonvorobets.substack.com/p/9-portfolio-optimization-and-parameter-uncertainty

Portfolio Optimization and Parameter Uncertainty post: https://antonvorobets.substack.com/p/portfolio-optimization-and-parameter

Portfolio Construction and Risk Management Book latest PDF: https://antonvorobets.substack.com/p/pcrm-book

fortitudo.tech Python package walkthrough YouTube playlist: https://www.youtube.com/playlist?list=PLfI2BKNVj_b2rurUsCtc2F8lqtPWqcs2K