Causal Stress-Testing

This post gives a high-level presentation of the Causal and Predictive Market Views and Stress-Testing SSRN article.

The Causal and Predictive Market Views and Stress-Testing framework1 might seem very complex at first.

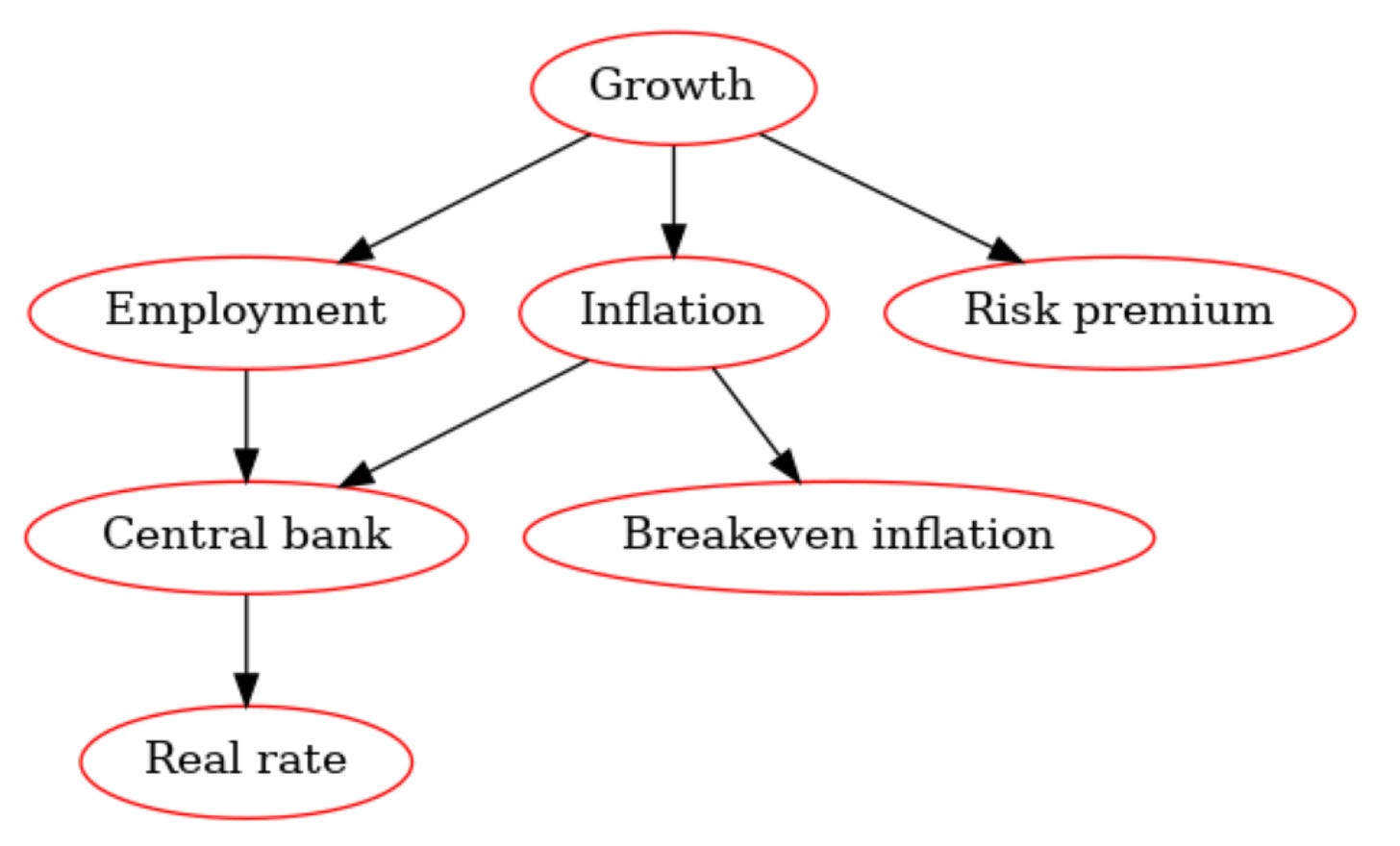

However, it is essentially a combination of Entropy Pooling2 with a Bayesian network on top that generates joint causal views and their probabilities.

For sophisticated use of the framework, it is always recommended to use Sequential Entropy Pooling3.

A cohesive presentation of all the methods and their interaction is given in Chapter 5 of the Portfolio Construction and Risk Management book4.

Causal and Predictive Market Views and Stress-Testing Framework

The Causal and Predictive Market Views and Stress-Testing framework allows us to implement causal views for fully general investment distributions and even condition on realizations of different variables.

For example, using the Bayesian network from the cover image, we can condition on a scenario where growth is low, inflation is high, and the central bank decides to increase interest rates.

This scenario can rightfully be called “stagflation + rate hike”. Below, we assess the effect on a low risk portfolio consisting of 25% equities and 75% bonds:

Although the portfolio return distributions are interesting to analyze on their own, it is when we analyze the joint distributions of the individual assets that we can get deeper insights:

While it is no surprise that nominal government bond distributions shift to the left when inflation and interest rates increase, similarly to equity distributions shifting to the left when growth is low and interest rates increase, the framework allows us to have quantitative estimates of the magnitude.

With the joint scenarios, it also becomes easier for us identify the joint tail risks that we need to hedge if we want to equip the portfolio with a tail risk hedge as described in Chapter 7 of the Portfolio Construction and Risk Management book.

The article contains several additional case studies and perspectives that you are encouraged to study in addition to the technical details of how the framework is implemented.

Video walkthrough

You can watch a video walkthrough of the article and its accompanying code5 here:

Exclusive case studies

Paid subscribers have access to an expanding collection of exclusive case studies going through the theory and methods presented above.

As a free subscriber, you can claim a one-time access to a paid post.

Consider a paid subscription to lock in the current subscription price.

Causal and Predictive Market Views and Stress-Testing SSRN article: https://ssrn.com/abstract=4444291

Entropy Pooling Collection post: https://antonvorobets.substack.com/p/entropy-pooling-collection

Sequential Entropy Pooling post: https://antonvorobets.substack.com/p/sequential-entropy-pooling

Portfolio Construction and Risk Management Book post: https://antonvorobets.substack.com/p/pcrm-book

Causal and Predictive Market Views and Stress-Testing Python code: https://github.com/fortitudo-tech/fortitudo.tech/blob/main/examples/8_CausalPredictiveFramework.ipynb