eBook, Python code, and one-year paid subscription

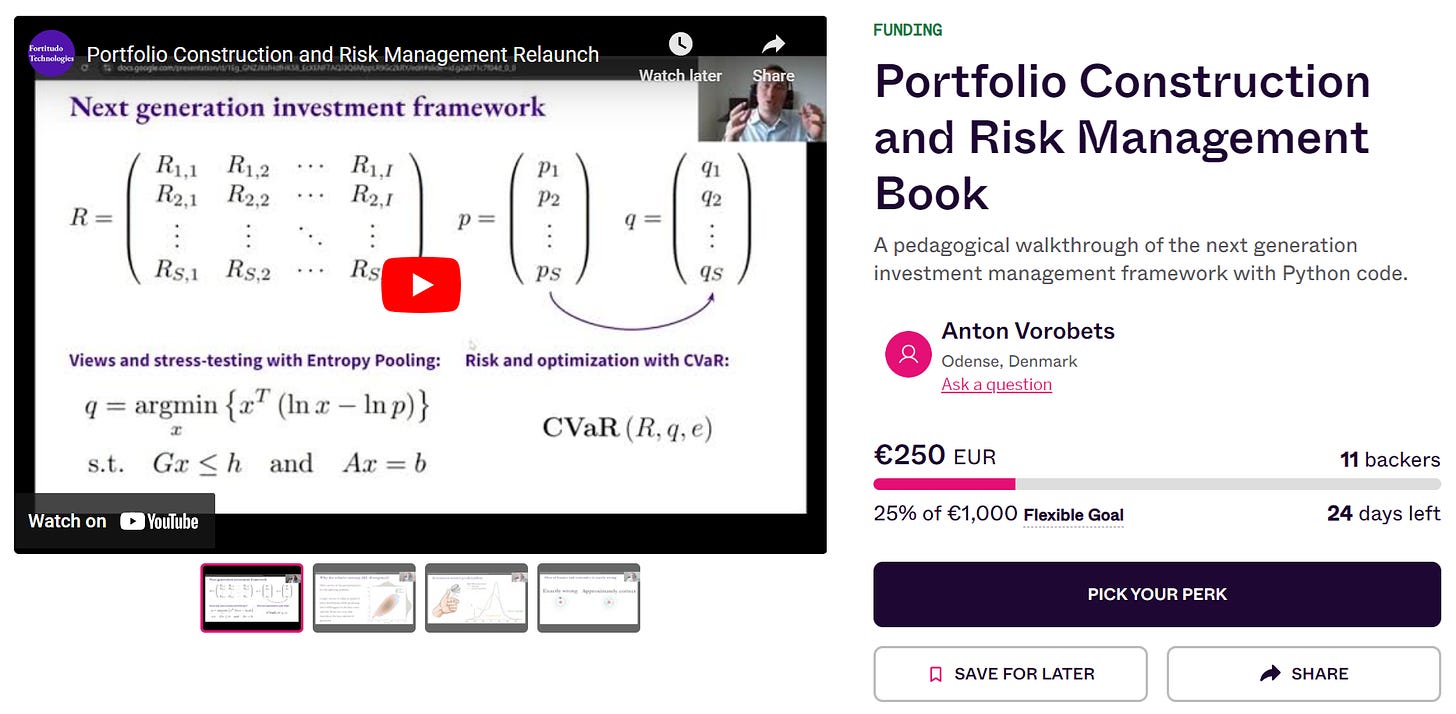

This post presents all the benefits you get for contributing to the crowdfunding of the Portfolio Construction and Risk Management book: https://igg.me/at/pcrm-book

As an extra bonus, all contributors to the Portfolio Construction and Risk Management book crowdfunding1 who claim a perk before November 2, 2024 at 7:59 AM GMT+1 will, besides access to the book and accompanying Python code, get a complimentary one-year paid Substack subscription to the Applied Quantitative Investment Management publication, which is currently priced at €50 per year.

I have made a commitment to only answer questions about the next generation investment framework, which utilizes fully general Monte Carlo distributions, Entropy Pooling, and CVaR, to people who contribute to the crowdfunding of the Portfolio Construction and Risk Management book.

When the book is finished, I will only answer questions to paid Substack subscribers through the Substack chat. Hence, as a contributor before November 2, 2024 at 7:59 AM GMT+1 you will be able to continue to ask questions a year after the book is finished. You will additionally get access to exclusive case studies that use the investment framework from the book in addition to other occasional benefits. Watch this video that explains all this in greater detail:

If you happen to be among the top 10 contributors once the book is finished (sometime at the beginning of next year), you will additionally get three month access to an institutional-grade implementation of the investment framework from the book to really test out your newly acquired knowledge. The value of this access for institutional investors is more than 10 times the crowdfunding target of the second campaign.

As of October 16, your total contribution must be above €45 to enter the current top 10. This number will be continuously updated in the sneak peek version of the book2 until the book is finished and the final top 10 decided.

Book status

The book contains many new results on Entropy Pooling3, portfolio optimization with parameter uncertainty4, portfolio rebalancing5, time- and state-dependent resampling, as well as many pedagogical parts that fill in the gaps compared to my scientific articles6.

The book is currently missing Chapter 2 on stylized market facts and Chapter 4 on instrument pricing. Besides that, there are sections missing on generative machine learning methods for synthetic market simulation, simulation evaluation, and tail risk hedging.

How much time and effort I put into the remaining parts is directly proportional to the amount of monetary support the book receives. At the current level of support, the opportunity costs are simply too high for me to put in the same amount of effort as I have done for the previous chapters.

If you still do not have access to the book, I encourage you to get it as soon as possible to maximize your benefits. Watch this video for all the details you need about how you get access:

Thank you and an ask for help

If you are a current reader of the book, I thank you very much for your support. I treat crowdfunding contributors as friends and will continue to do so once the book is finished.

I get a lot of positive feedback from current readers, which I am very happy for. I kindly ask you to share this positive feedback with your social networks, so more people can get the benefit of the book. LinkedIn has unfortunately been a very unstable platform for me lately, so even though people help me with likes and shares of posts that encourage contributions to the book, they are simply not being shown to a wider audience.

Hence, I highly encourage you to share your positive experiences directly with your network. Please feel free to tag me in the posts, so I can like, share, and comment on them.

Portfolio Construction and Risk Management book crowdfunding: https://igg.me/at/pcrm-book

Portfolio Construction and Risk Management book sneak peek: https://ssrn.com/abstract=4807200

Entropy Pooling Collection Substack post: https://antonvorobets.substack.com/p/entropy-pooling-collection

Portfolio Optimization and Parameter Uncertainty Substack post: https://antonvorobets.substack.com/p/portfolio-optimization-and-parameter

Intelligent Portfolio Rebalancing Substack post: https://antonvorobets.substack.com/p/intelligent-portfolio-rebalancing

Anton Vorobets SSRN author page: https://www.ssrn.com/author=2738420