This is the sixth video that goes through the fortitudo-tech Python package available at: https://github.com/fortitudo-tech/fortitudo.tech1

The video goes through the fifth example which presents the stochastic differential equation (SDE) simulation that follows with the fortitudo.tech Python package.

You can use this time series simulation to validate your simulation methods. It represents approximately 20 years of trading days data.

For a deep and pedagogical walkthrough of the investment framework and methods, see Portfolio Construction and Risk Management book2.

You can still contribute to the project and get perks for your contribution by becoming a paid subscriber to this publication, which will give you access to the Applied Quantitative Investment Management course5 and the expanding collection of exclusive case studies.

Watch the next video here:

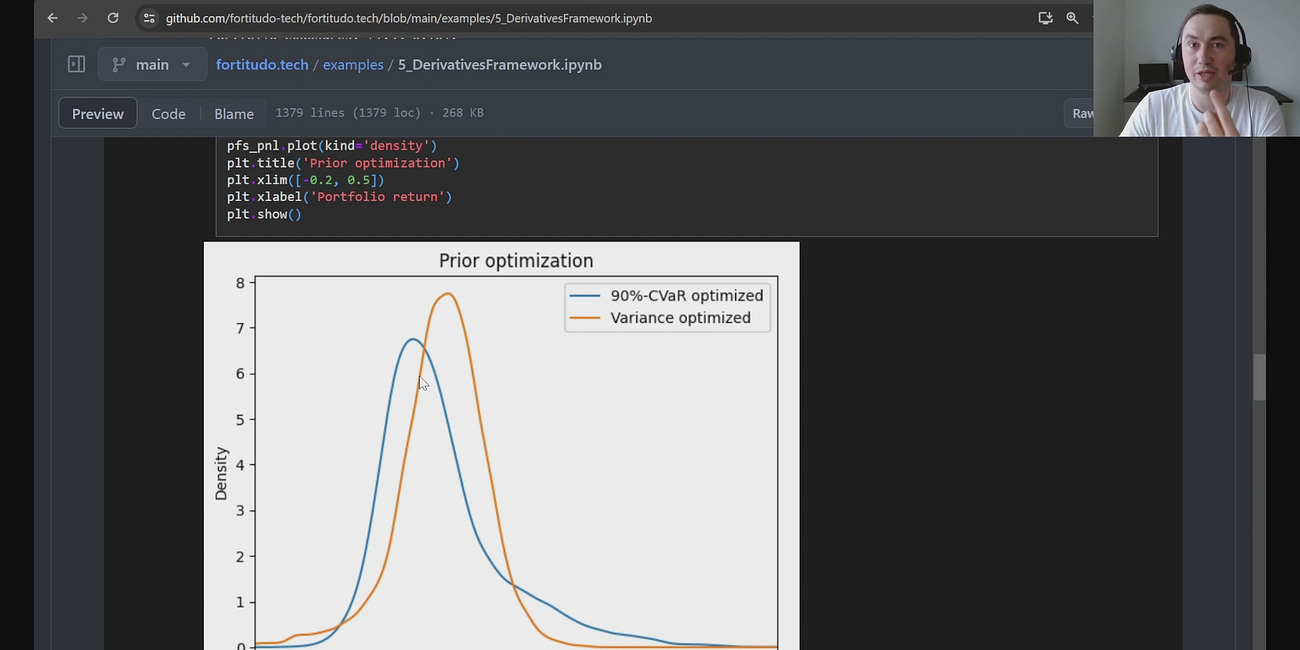

5. Derivatives Portfolio Management Framework

This is the seventh video that goes through the fortitudo-tech Python package available at: https://github.com/fortitudo-tech/fortitudo.tech

This video is also available on YouTube3 if you prefer watching it there.

GitHub repository for the fortitudo.tech Python package: https://github.com/fortitudo-tech/fortitudo.tech

Portfolio Construction and Risk Management Book latest PDF: https://antonvorobets.substack.com/p/pcrm-book

fortitudo.tech Python package walkthrough YouTube playlist: https://www.youtube.com/playlist?list=PLfI2BKNVj_b2rurUsCtc2F8lqtPWqcs2K