Portfolio Construction and Risk Management Book

This article gives insights into the Portfolio Construction and Risk Management book, and how it is different from the current standard.

This article explains how the investment framework from the Portfolio Construction and Risk Management book is different from the current mainstream quantitative investment management approach.

The book is currently being written through a crowdfunding campaign1 that you can support to get access to the book, accompanying Python code, and a community forum, where you can ask questions and I will give answers. It is a great opportunity to learn the content interactively with other campaign backers. You can get a sneak peek into the book through SSRN2.

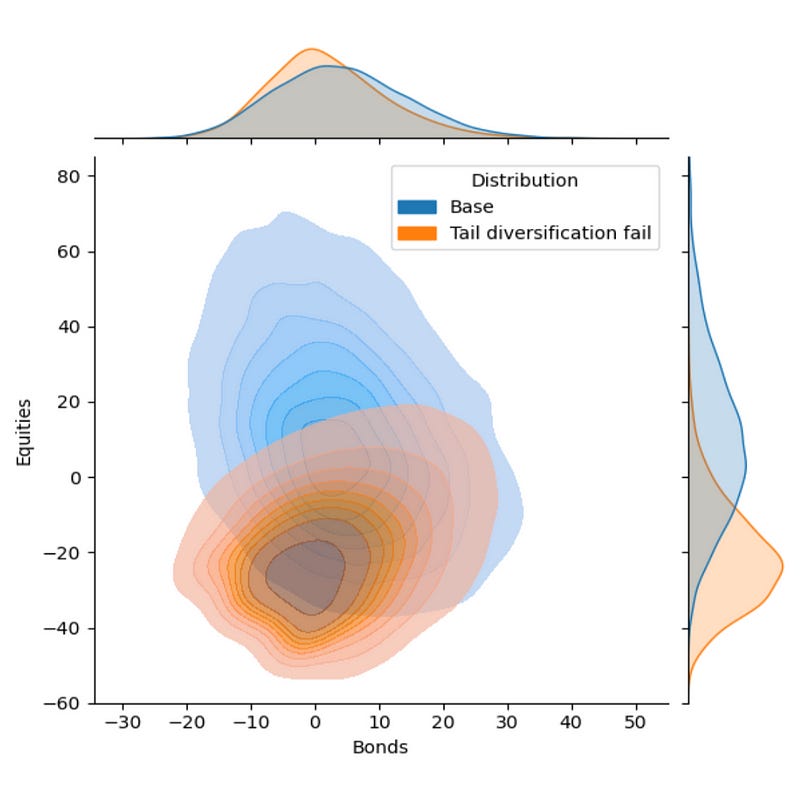

The book will contain a careful and pedagogical walkthrough of the next generation investment framework that utilizes fully general Monte Carlo distributions, Entropy Pooling3, and CVaR. You can read more about the framework in the Entropy Pooling and CVaR Portfolio Optimization in Python article4 as well as watch the crowdfunding relaunch video below.

The issues with the current standard

If you have a finance and economics education or ever searched for portfolio optimization, you have probably come across models like CAPM, Black-Litterman5, and mean-variance. These theories are fairly simple, so most people can understand them. There is an entire industry around teaching this to investment novices and students at universities. What this industry does not tell you is that these theories and methods have very little to do with the real world, and that they won’t give you an investment edge.

Successful investing is about doing something different and better than the market. It is an accumulation of consistently getting many small things right. Given that the textbooks methods are not only highly unrealistic but also easily available to mom-and-pop investors, it should be clear that there is no excess return in using them.

However, many articles, books, and courses have been created based on them, so many people and organizations have a clear economic interest in maintaining the relevance of the old theories and methods. I explain more about these issues in the video below.

The essence of investment and risk management

The first chapter of the book introduces some important concepts related to market state, structural breaks, and time-conditioning. Finally, there is an explanation of the essence of investment management that you can find a short summary of in the video below.

Conclusion

If you want to build a deep understanding of the next generation investment management framework, your best opportunity is to contribute to the crowdfunding campaign. It gives you the opportunity to master these theories and methods before most other market participants.

If you want to study the framework before the book, you can find the most relevant articles here6. The accompanying code to these articles can be found in the examples of the fortitudo.tech Python package7. However, this material is a lot more concise than the book and therefore contains more subtleties that you need to figure out on your own. The intention of the book is to give a more coherent and explicit presentation of the investment framework including all these subtleties.

Getting access to the book and Python code

You can get access to the book, the accompanying Python code, and a community forum where you can ask questions by contributing at least €15 to the crowdfunding campaign at https://igg.me/at/pcrm-book. Watch the first video above from 2:28 for the details of how you contribute and get access.

Portfolio Construction and Risk Management crowdfunding campaign: https://igg.me/at/pcrm-book

Portfolio Construction and Risk Management sneak peek: https://ssrn.com/abstract=4807200

Entropy Pooling Collection post: https://antonvorobets.substack.com/p/entropy-pooling-collection

Entropy Pooling and CVaR Portfolio Optimization in Python post: https://antonvorobets.substack.com/p/entropy-pooling-and-cvar-portfolio-optimization-in-python-ffed736a8347

Entropy Pooling vs Black-Litterman post: https://antonvorobets.substack.com/p/entropy-pooling-vs-black-litterman-abb608b810cd

SSRN author page for Anton Vorobets: https://ssrn.com/author=2738420

fortitudo.tech Python package: https://github.com/fortitudo-tech/fortitudo.tech