Portfolio Construction and Risk Management Foundation

This post explains how the foundational parts of the Portfolio Construction and Risk Management book are now finished: https://igg.me/at/pcrm-book

All the core parts of the Portfolio Construction and Risk Management book are now finished.

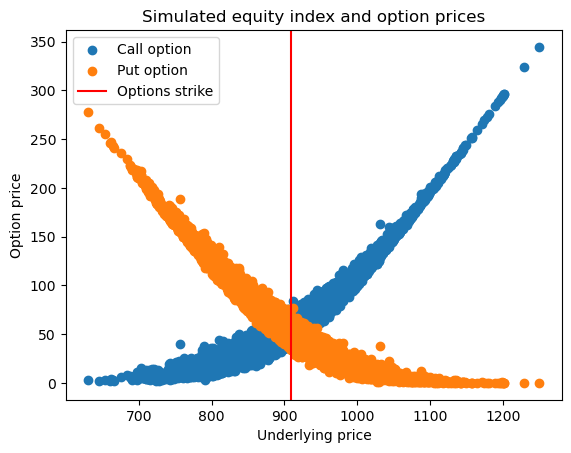

I now recommend reading the book from start to finish to fully understand all the elements of its investment framework, which utilizes fully general Monte Carlo distributions, Sequential Entropy Pooling1, and CVaR optimization2.

Along the way, you will come across many new results and perspectives. There are several original and practically useful Python case studies that you will not find anywhere else.

Some niche sections are still missing on generative machine learning, simulation evaluation, alternatives pricing, and tail risk hedging.

The minimum price for getting access will increase after December 20, so spoil yourself with a holiday gift before.

Note there are Substack benefits and acknowledgement for significant contributors3. Find all the information and get access here: https://igg.me/at/pcrm-book4

Find the latest version of the sneak peek in the PDF below:

Entropy Pooling Collection: https://antonvorobets.substack.com/p/entropy-pooling-collection

Entropy Pooling and CVaR Portfolio Optimization in Python: https://antonvorobets.substack.com/p/entropy-pooling-and-cvar-portfolio-optimization-in-python-ffed736a8347

Portfolio Construction and Risk Management Update: https://antonvorobets.substack.com/p/portfolio-construction-and-risk-management

Portfolio Construction and Risk Management book crowdfunding: https://igg.me/at/pcrm-book