Time- and State-Dependent Resampling

This post presents a high-level summary of the Time- and State-Dependent Resampling article, including the Fully Flexible Resampling method.

Generating realistic future paths for investment market time series is crucial for risk management, good backtesting1, fully general stress-testing2, and CVaR tail risk optimization, see the Portfolio Construction and Risk Management book3.

The recent Time- and State-Dependent Resampling article4 presents a new class of resampling methods for high-dimensional investment market simulation and contains a case study using the Fully Flexible Resampling method, which was first presented in the Portfolio Construction and Risk Management book.

When generating joint paths for investment time series, we must capture both the cross-sectional and time series dependencies, making the problem more challenging than just cross-sectional data or univariate time series.

The advantage of resampling methods is that they are capable of capturing the cross-sectional dependencies no matter how complex they are, or how high-dimensional our simulation is.

The challenge for resampling methods is capturing the time series dependencies, which is why different block bootstrapping and filtering methods have been introduced.

The Time- and State-Dependent Resampling Class

The Time- and State-Dependent Resampling class of methods is characterized by resampling of historical scenarios over several weighted probability vectors governed by an implicit or explicit Markov chain. For the precise definitions, see the article.

Kristensen and Vorobets (2025) proves that the method generates strictly stationary joint simulated paths. Hence, the historical data should be transformed in a way that makes it stationary, see Section 3.1 in the Portfolio Construction and Risk Management book.

The Fully Flexible Resampling method

The Fully Flexible Resampling method is a special case of the Time- and State-Dependent Resampling class, which uses Entropy Pooling to compute the weighted probability vectors.

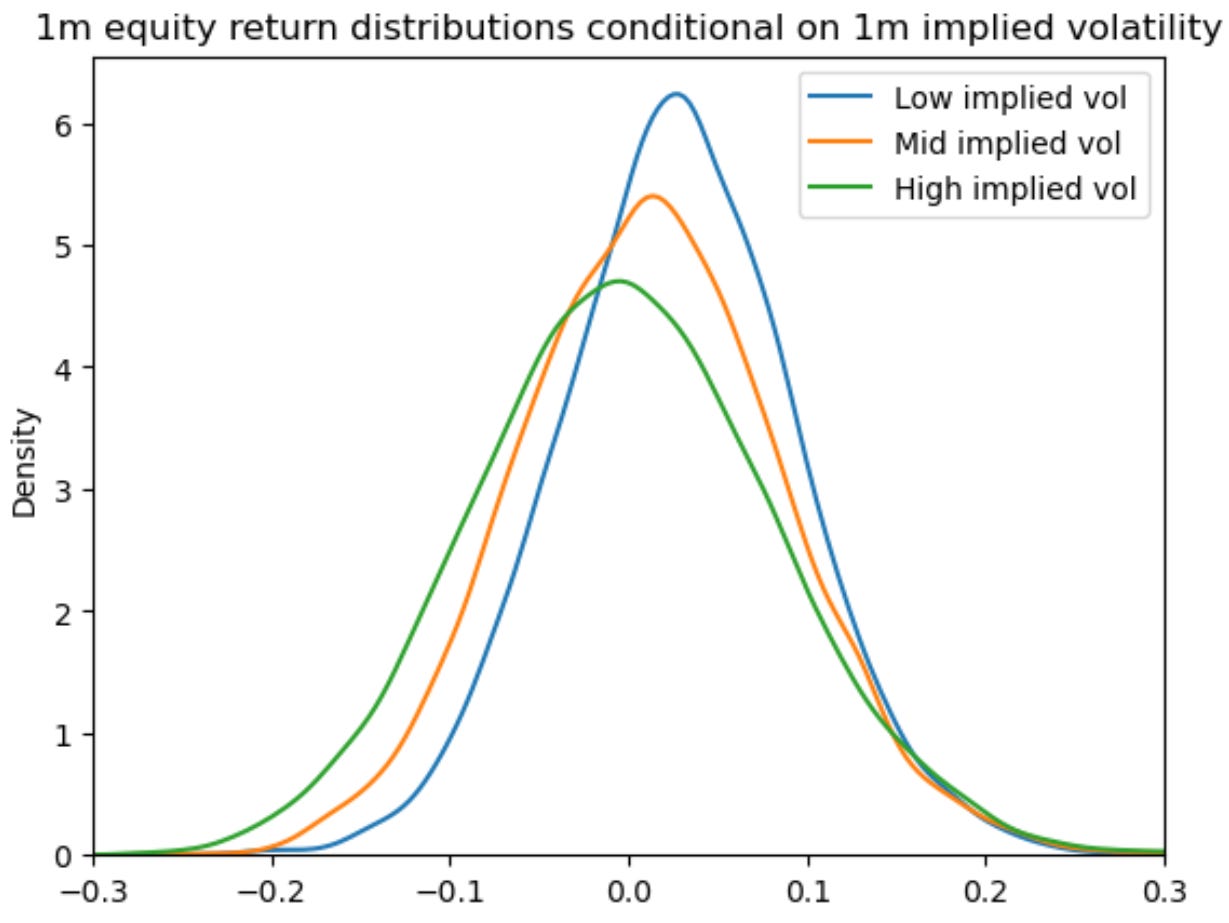

The Fully Flexible Resampling method allows us to combine time decay with multiple arbitrarily complex state variables. In the case study of the Time- and State-Dependent Resampling article, we use the one-month at-the-money implied volatility and classify it into “low”, “medium” and “high” states, see the graph below:

We then combine the implied volatility state classification with exponential time decay to generate the historical probability vectors that are illustrated in the cover image to this article.

The actual resampling procedure is spelled out in the article, including an explanation of how it results in an implicit Markov chain.

The Fully Flexible Resampling method can be used to simulate future paths conditional on the initial state. This can also be used for stress-testing to assess the effect of, for example, being in a high implied volatility state compared to a low volatility state, see the graph below:

You can verify that the state dependence disappears on longer horizons, such as one year, by adjusting the accompanying code to the article5. This is exactly as we would expect due to the stationarity of the Time- and State-Dependent Resampling procedure.

You can find a presentation of how to combine multiple state variables in the article or the Portfolio Construction and Risk Management book.

Exclusive case studies

Paid subscribers6 have access to walkthroughs of exclusive case studies7 that include examples of how to combine multiple state variables for the Fully Flexible Resampling method as well as a presentation of the stationary transformations and market simulation theory.

As a free subscriber, you can claim a one-time access to a paid post.

Future paid posts will contain many exclusive case studies using the next generation investment framework8. Consider a paid subscription to lock in the current subscription price.

Better Backtesting post: https://antonvorobets.substack.com/p/better-backtesting

Entropy Pooling Collection post: https://antonvorobets.substack.com/p/entropy-pooling-collection

Portfolio Construction and Risk Management Book post: https://antonvorobets.substack.com/p/pcrm-book

Time- and State-Dependent Resampling SSRN article: https://ssrn.com/abstract=5117589

Time- and State-Dependent Resampling accompanying code: https://github.com/fortitudo-tech/fortitudo.tech/blob/main/examples/11_TimeStateResampling.ipynb

Introducing Paid Content post: https://antonvorobets.substack.com/p/introducing-paid-content

Investment Simulation post: https://antonvorobets.substack.com/p/2-investment-simulation

Anton Vorobets, Next Generation Investment Analysis @ The London Quant Club YouTube video