Course Feedback

This post gives a summary of the Applied Quantitative Investment Management course and asks for your feedback.

Thank you for the positive feedback on the Applied Quantitative Investment Management course.

If you haven’t seen it yet, check out the currently available lectures below. So far, we have completed the first four chapters of the Portfolio Construction and Risk Management book and introduced Entropy Pooling in the first section of Chapter 5.

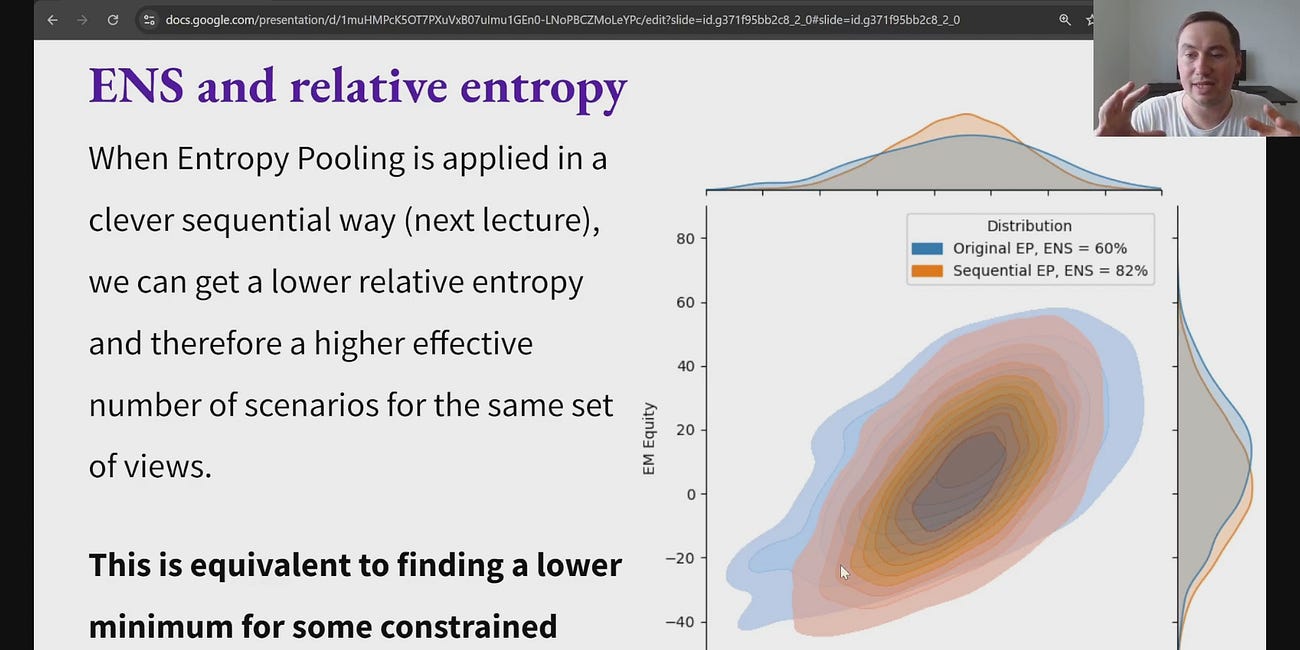

The next six lectures will give a deep presentation of Sequential Entropy Pooling, Causal and Predictive Market Views and Stress-Testing, Resampled Portfolio Stacking, and derivatives portfolio optimization with parameter uncertainty.

I have taken note of the constructive feedback that some of you have provided about the pace of the course. As a consequence, I will slow down a bit in the remaining lectures and present the mathematical details more slowly.

I will also take a break from the lecture this week to allow you to catch-up after the summer holidays.

Please feel free to share your feedback, which allows me to potentially improve the remaining six lectures.

Applied Quantitative Investment Management lectures

Below is an overview of the course lectures as of August 13, 2025. These lectures provide the foundation for the remaining advanced investment analysis methods that we will be going through, so I highly encourage you to carefully watch them and study the content before we continue with the next lecture about Sequential Entropy Pooling.

The first lecture is free, so anyone can watch it and get a sense of the course content. Only paid subscribers can access the remaining lectures, slides and ask questions.

Lecture 6: Entropy Pooling

This is the sixth lecture of the Applied Quantitative Investment Management course.

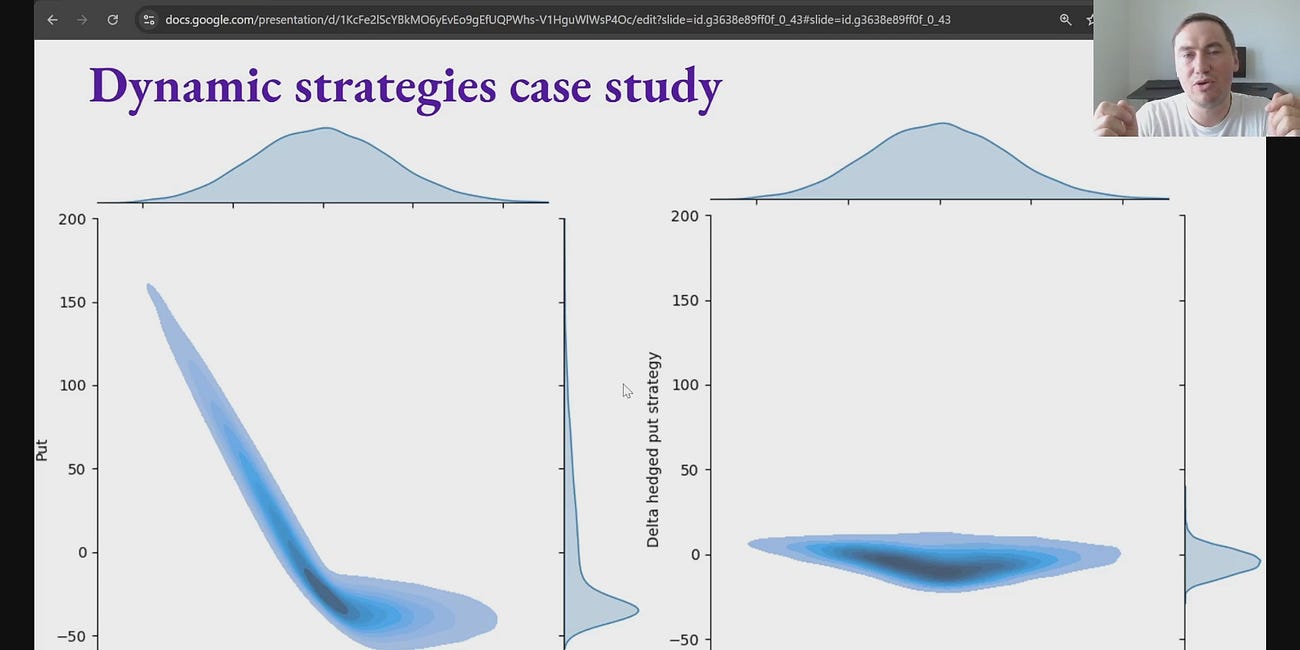

Lecture 5: Instrument Pricing

This is the fifth lecture of the Applied Quantitative Investment Management course.

Lecture 4: Resampling and Generative Machine Learning

This is the fourth lecture of the Applied Quantitative Investment Management course.

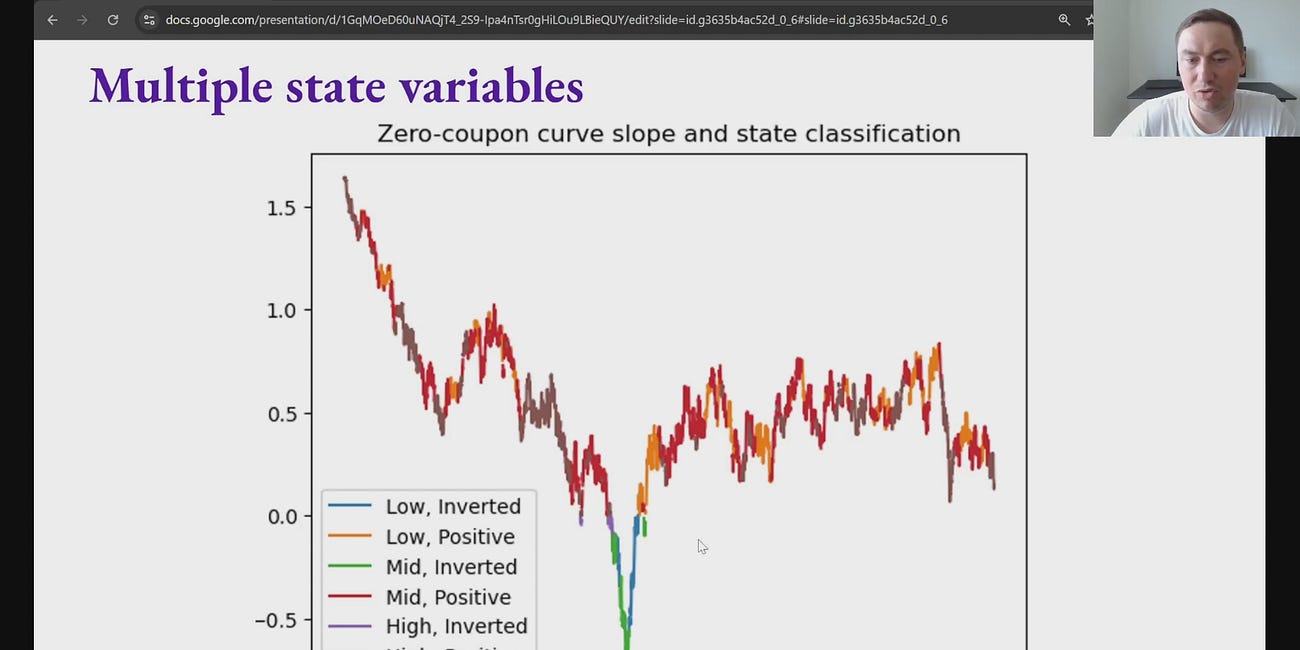

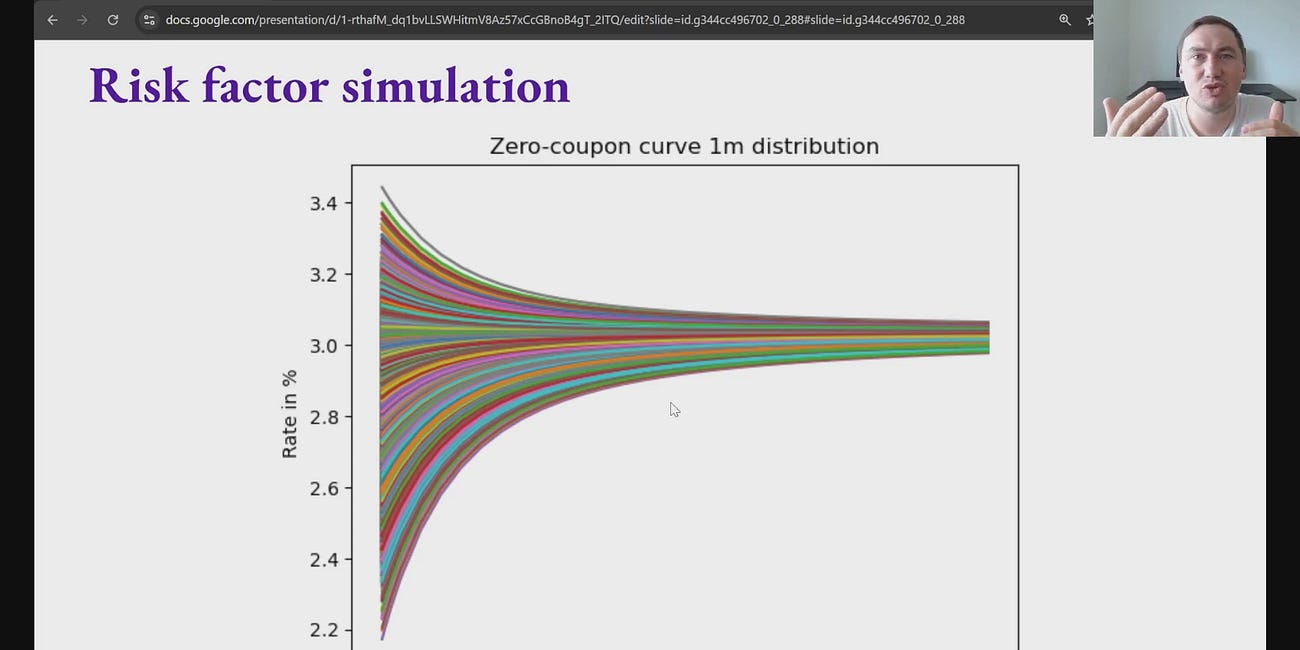

Lecture 3: Investment Simulation Framework

This is the third lecture of the Applied Quantitative Investment Management course.

Lecture 2: Stylized Market Facts

This is the second lecture of the Applied Quantitative Investment Management course.

Lecture 1: Intro and Python setup

This is the first lecture of the Applied Quantitative Investment Management course that goes through the Portfolio Construction and Risk Management book and its accompanying Python code.